Let’s be real—budgeting with ADHD can feel like climbing a mountain with roller skates on. Between working memory challenges, dopamine-chasing impulse buys, and the sheer dread of opening your banking app, traditional money advice often just… doesn’t fit.

But that doesn’t mean you’re bad with money. It just means your brain needs a different system. One that’s visual, forgiving, and easy to start.

That’s why I teamed up with financial advisor (and fellow neurospicy human) Courtney Cuppernull of Northwestern Mutual to host a session called “Money Planning for Brains That Don’t Like Budgets.” Together, we walked through tools, truths, and mindset shifts that actually work for ADHDers.

Here’s a quick summary—plus your free starter guide!

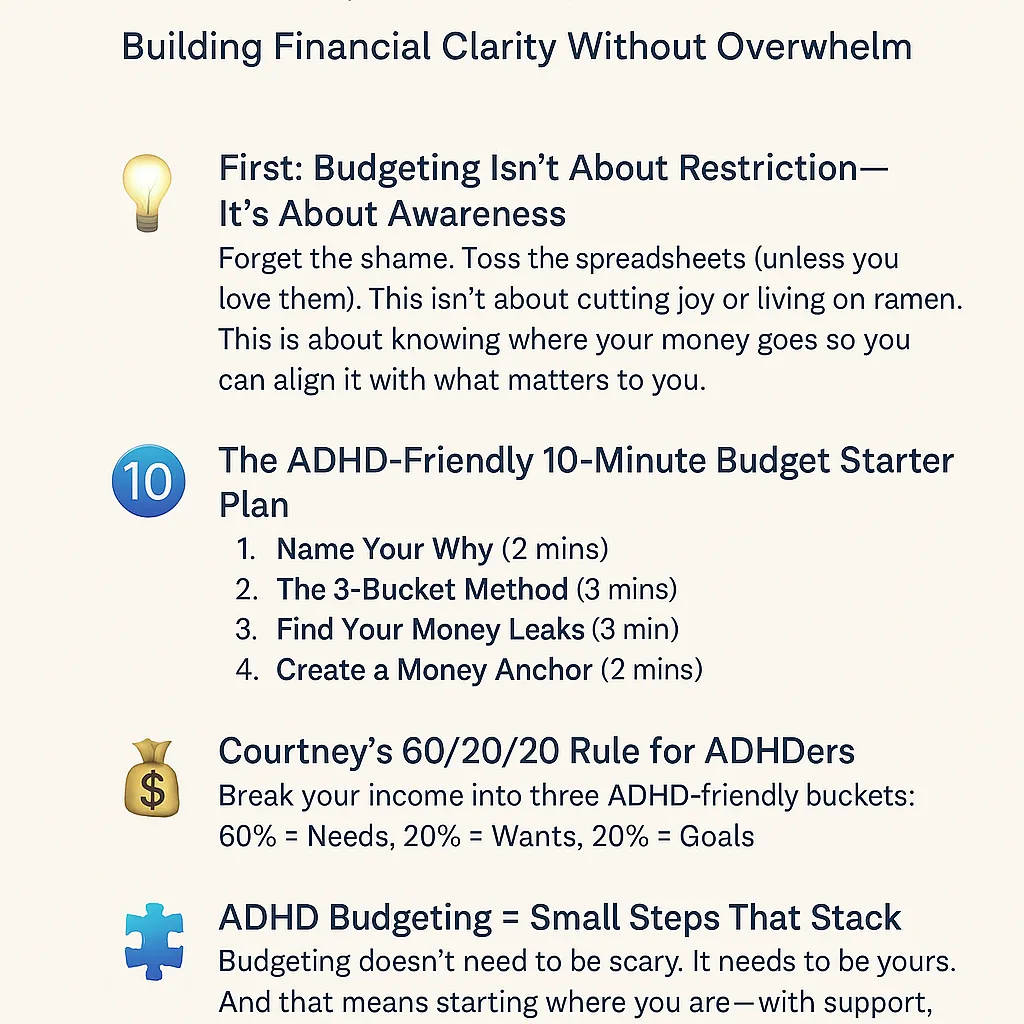

💡 First: Budgeting Isn’t About Restriction—It’s About Awareness.

Forget the shame. Toss the spreadsheets (unless you love them).

This isn’t about cutting joy or living on ramen.

This is about knowing where your money goes so you can align it with what matters to you.

🔟 The ADHD-Friendly 10-Minute Budget Starter Plan

Step 1: Name Your Why (2 mins)

Ask yourself: “Why do I want to get a handle on my money?”

So I feel less anxious? Take a trip? Create stability for my family?

Whatever it is—write it down and keep it visible.

Step 2: Use the 3-Bucket Method (3 mins)

Only 3 categories. Keep it simple:

- 🟦 Needs (rent, groceries, bills)

- 🟩 Wants (fun stuff, self-care)

- 🟨 Goals (savings, debt paydown)

No math yet—just guess. You’re building awareness, not perfection.

Step 3: Find Your Money Leaks (3 mins)

Look at 1–2 weeks of spending.

Ask: Did I need this, want this, or did this surprise me?

Highlight anything that made you go “ugh” or “oops.” 👀

Step 4: Create a Money Anchor (2 mins)

Choose one ADHD-friendly habit:

- 📅 A 5-minute weekly “money check”

- 🔔 Phone reminder to check your balance

- 📲 Use visual apps like YNAB, Goodbudget, or RocketMoney

- 🧍🏽♀️ Body double your bill-paying during our Chaos2Clarity community sessions

💰 Courtney’s 60/20/20 Rule for ADHDers

Courtney, a licensed financial advisor with Northwestern Mutual, recommends breaking your money into three ADHD-friendly buckets:

- 60% = Needs

Rent, food, insurance, debt payments, anything non-negotiable. - 20% = Wants

Yes, fun money is budgeted on purpose. You’re allowed. - 20% = Goals

Savings, emergency fund, retirement, paying off credit cards.

💡 Tip: Set up automatic transfers so you don’t have to think about it.

🔁 ADHD Money Traps + How to Outsmart Them

- Impulse Shopping?

Try the Cart Strategy: Add items to your cart and wait 7 days.

At the end of the week, save one thing or put that money in savings. - Subscription Overload?

Use tools like RocketMoney or your iPhone settings to cancel auto-renewals. - Avoiding the Numbers?

Start with one week. One statement. One peek. Progress, not perfection. - Food Spending Spiral?

Create a meal plan with ingredients you already have. Use apps like ChatGPT or “SuperCook” to build recipes from your fridge.

🧩 ADHD Budgeting = Small Steps That Stack

Budgeting doesn’t need to be scary. It needs to be yours.

And that means starting where you are—with support, visuals, and the freedom to be messy.

Want help building your ADHD-friendly financial plan?

🔗 Try These Resources:

✅ Download the Google Sheets ADHD Budget Starter Guide (PDF)

✅ Connect with Shayne at Swift Lyfe Coaching for a free 1:1 coaching consultation

✅ Connect with Courtney at Northwestern Mutual for a free 1:1 financial consultation

🙌 Final Reminder:

You don’t have to “fix” yourself to feel financially free.

You just need tools that honor the way your brain works.

Let’s build a money system that fits your real life—one puzzle piece at a time.

#ADHDFinance #BudgetingWithADHD #NeurodivergentMoney #FinancialWellness #ChaosToClarity #ImpulseSpendingTips #MoneyMindset #ExecutiveFunctionSupport #BodyDoubling #ADHDCoach